By: Cindy Cushman, Owner & Lead HR Partner, HR2fit

On March 18, 2020, The Families First Coronavirus Response Act was signed into law.

WHAT TO EXPECT

COVID-19 is a highly contagious virus that can cause fever, respiratory problems, and sometimes gastrointestinal issues. The Families First Coronavirus Response Act (FFCRA or Act) requires certain employers to provide their employees paid sick leave. The Act also expanded family and medical leave for specified reasons related to COVID-19.

These provisions will apply from April 1, 2020 through December 31, 2020.

PAID LEAVE SICK LEAVE

Over-all, employers covered under the Act must provide employees: Up to two weeks (80 hours, or a part-time employee’s two-week equivalent) of paid sick leave based on the higher of their regular rate of pay, or the applicable state or Federal minimum wage, paid.

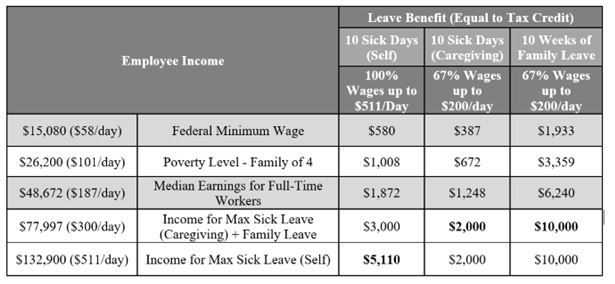

Employers must offer two weeks (10 days) of paid sick leave for the COVID-19 related reasons. If the sick leave is for an employee who is themselves sick the benefit must replace all the employee’s wages up to a maximum benefit of $511 per day. The federal government has issued a tax credit to offset 100% of sick leave up to $511 per day capped at $5,110 and an uncapped amount of the employer contribution for health insurance premiums for the employee during their sick leave. Employers receive the offset through their quarterly payroll tax credit. Refund checks are issued to employers once quarterly taxes are filed.

PAID FAMILY LEAVE

Employers must offer 12 weeks of paid family leave for an employee, if an employee is caring for another individual for COVID-19 related reasons. In addition, employers must offer 12 weeks of paid family leave for an employee with a minor child in the event of the closure of the child’s school or place of care. The first 10 days are unpaid, and employees may use other accrued time such as sick, vacation or personal to cover the 10 days of unpaid time. This benefit must replace at least two-thirds of the employee’s wages up to a maximum of $200 per day and capped at $10,000. Employers receive the offset through their quarterly payroll tax credit. Refund checks are issued to employers once quarterly taxes are filed.

ELIGIBLE EMPLOYEES

In general, employers with fewer than 500 employees, are eligible for up to two weeks of fully or partially paid sick leave for COVID-19 related reasons (see below). Employees who have been employed for at least 30 days prior to their leave request may be eligible for the expanded FMLA.

Qualifying Reasons for Leave:

According to the Department of Labor: Under the FFCRA, an employee qualifies for paid sick time if the employee is unable to work (or unable to telework) due to a need for leave because the employee:

- is subject to a Federal, State, or local quarantine or isolation order related to COVID-19;

- has been advised by a health care provider to self-quarantine related to COVID-19;

- is experiencing COVID-19 symptoms and is seeking a medical diagnosis;

- is caring for an individual subject to an order described in (1) or self-quarantine as described in (2);

- is caring for a child whose school or place of care is closed (or childcare provider is unavailable) for reasons related to COVID-19; or

- is experiencing any other substantially-similar condition specified by the Secretary of Health and Human Services, in consultation with the Secretaries of Labor and Treasury.

Under the FFCRA, an employee qualifies for expanded family leave if the employee is caring for a child whose school or place of care is closed (or childcare provider is unavailable) for reasons related to COVID-19.

The following chart explains minimum and maximum payments:

Source: House Ways and Means Committee

By: Cindy Cushman

Owner & Lead HR Partner, HR2fit

www.HR2fit.com

781-436-5399