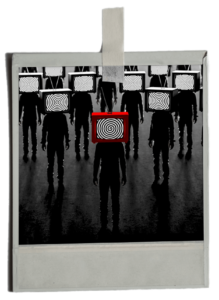

THE DANGERS OF SOCIAL MEDIA $INFLUENCERS

What’s the “hottest” financial tip or “trade secret” you’ve seen on social media recently?

What about retirement hacks, crypto offers, or “cutting-edge” investing advice?

If you’re a social media user (like most), the financial “expert” chatter is almost inescapable.1

So-called “$influencers” are on nearly every social platform.

They tend to offer shortcuts and make grand promises and claims that seem too good to be true.

Yet many of us buy in without hesitation.2

More than ever, we’re using social media to learn about money matters.2, 3

But that’s risky.

And not the best way to receive balanced financial support and factual advice that is tailored for our unique lives.

Keep scrolling to learn why social media and financial planning––don’t mix.

3 BIG RISKS WHEN USING SOCIAL MEDIA FOR FINANCIAL GUIDANCE

Blindly buying in to what’s popular, commonly referred to as “herd mentality,” involves following the masses without thinking twice or making conscious decisions.4 This mob behavior can run rampant on social media.4, 5 It can also be easier to fall victim to when we have “FOMO” (fear of missing out) or when we rely on mental shortcuts.5

Example: Remember the GameStop debacle? Their stock shot up wildly in value in January 2021. And behind the roughly 20x rise in this stock’s price was herd mentality, mostly drummed up on Reddit and facilitated by the new-age stock trading platform. After several investors got in on the action, the price of GameStop stock took a nosedive. Many individual investors and hedge funds lost big.5

RISK #2: IDOLIZING AN ILLUSION

RISK #2: IDOLIZING AN ILLUSION

Misinformation isn’t new to social media, but under the guise of “advice” from a wealthy finfluencer, it can be much harder to spot. Sponsored posts from high-profile “celebrities” in finance or business can be even more persuasive, causing a rush to emulate what likely isn’t real (or attainable). And many of us mistake high-volume shares, followers, and likes as evidence of distinction and integrity.6

Example: A few years ago, a well-known influencer with over 800K followers, made nearly $190,000 after charging almost $500 per student for a 12-week course on how to build your own travel-blogging business. Once the course began, frustrations started trickling in, stating that the content wasn’t as advertised. The influencer then blocked those who complained, leaving most “students” at a loss. It’s unclear if any money was refunded.7

RISK #3: SINKING INSIDE A SCHEME

RISK #3: SINKING INSIDE A SCHEME

Get-Rich-Quick (GRQ) schemes promise fast, unrealistic returns if you invest, sign up, become a member, and/or “act now.” GRQ schemes seldom talk about risks, it’s all rewards—and you’re usually required to pony up a generous amount of cash or refer others to get started.8

The truth? Most GRQ schemes are a house of cards, conning the people who sign up and almost never making them rich. Instead, they likely end up “losing their shirts.”8

Example: Multi-level marketing (MLMs) schemes are all over social media. “Work from home,” or “Make $100,000 in your first month,” or “Be your own boss,” are some of their common promises. Most participants lose money in these schemes, and the few who find success typically have to invest and hustle for years. (Which, could’ve been the timeline for launching a successful non-MLM business.)8

“THERE’S NO WAY SOCIAL MEDIA CAN ADVISE OR GUIDE YOU ON A PERSONAL LEVEL.”

FINANCIAL LESSON:

RINSING AWAY THE SNAKE OIL

If you draw anything from this message today, let it be this: finfluencers are not fiduciaries.

Their incentive and allegiance is dedicated to a social platform’s algorithm that will reward them for collecting as many VIEWS as possible––not for providing life-changing or fair financial advice.

Social media is not inherently bad, but finfluencers don’t pay their bills by serving your best interests.

Thoughtful guidance isn’t typically sensational enough to grab “likes,” but heavily biased, outlandish, and polarizing information––usually is.

Bottom line? No one, whom you’ve never met, can offer the customized support you truly need and deserve.

A knowledgeable financial advisor who will meet with you one-on-one, however…

Sources

- https://www.pewresearch.org/internet/fact-sheet/social-media/

- https://www.kansascityfed.org/research/payments-system-research-briefings/social-media-for-personal-finances-a-new-trend-for-millennials-and-gen-z/

- https://www.financialplanningassociation.org/learning/publications/journal/SEP23-who-uses-social-media-investment-advice-OPEN

- https://www.investopedia.com/terms/h/herdinstinct.asp

- https://dobetter.esade.edu/en/digital-herd-behaviors

- https://phys.org/news/2023-03-social-media-platforms-accuracy.html

- https://globalnews.ca/news/4763046/aggie-lal-master-class-scam/

- https://www.sofi.com/learn/content/get-rich-quick-schemes/

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Securities offered through Supreme Alliance LLC, Broker/Dealer, RIA, Member FINRA

This communication is for informational purposes only and is not intended to replace the need for independent tax, accounting, or legal review. Individuals are advised to seek the counsel of such licensed professionals concerning how these tax advantages, if any, may apply to your specific circumstances.

Contact Info:

Jim Moniz MSFS & Dr. Kate Leonard

Northeast Wealth Management

(781) 353-5043

Schedule an appointment with us: https://calendar.linktivity.net/JimMoniz