Summary

Q: Where is the video?

A: We spared you a 2 hour video that would have been necessary to explain all of the information below. (Don’t worry, we will be back on camera soon!)

Q: How much information is there below?

A: A lot! 3 important topics

- PPP 2nd Draw Forgiveness

- HHS Provider Relief Funds (PRF) Update

- HHS Provider Relief Fund – Phase 4 Funding

There is a significant amount of very valuable information below. Please take the time to read and watch the videos provided in order to better understand the timing of reporting requirements and application process.

PPP – 2nd Draw Forgiveness

Q: When should I apply for forgiveness?

A: There is no downside to waiting, as we don’t know if the application process will be further simplified.

Practices have 10 months to apply for forgiveness, AFTER your 24 week covered period is up, which began when you received the funds.

Q: How do I apply for forgiveness?

A: Check with your bank and consider whether you are comfortable applying yourself.

For Rosen Clients Only, if you need assistance with PPP 2nd Draw forgiveness, please sign up at our website (www.rosendentalcpa.com) and click on the PPP (2nd Draw) Forgiveness Program (P.F.P) button at the top of the page. We are accepting sign ups now, but not starting our program until January, 2022.

There will be an additional fee for this service.

HHS Provider Relief Funds (PRF) Update

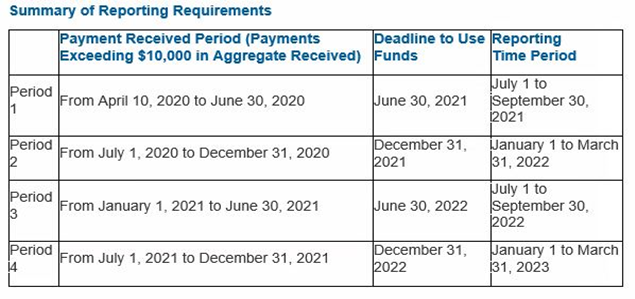

Q: When must I complete the reporting for the HHS funds I received?

Q: If I missed the 9/30 deadline to report, what do I do?

A: There is a 60 day grace period, but we recommend completing the reporting in October. No further extension is expected.

Q: May a practice complete this reporting early?

A: No, reporting must be completed during the assigned reporting time period based on the chart above.

Q: Are there any exceptions to the reporting requirement?

A: Yes, if your practice received less than $10,000 in total during a period, the practice does not need to complete the reporting for that period.

Q: Does a practice that received payments in multiple periods need to complete multiple reports?

A: Yes, practices must complete the reporting requirements during the reporting time period for which payments were received. You may not “bunch” the reporting into one period if payments are in multiple periods.

Q: What should I do to get started?

A: Watch this video: Provider Relief Fund Reporting Technical Assistance Session – 1480779 (webcasts.com) (1 hour, but extremely helpful)

Q: Where can I learn more information and get templates to help me prepare?

Use the “reporting worksheet” on the the link above to gather the relevant information. Most of the data requested are internal metrics – patient revenue by category, the number of employees, the number of patients by quarter, etc. This information can be found in your internal dental software and is not in QuickBooks. We expect most practices that received funds in the first three reporting periods to use lost revenues from March 2020 until the time you fully opened your practice.

Q: What expenses do I report?

A: Click here to learn what expenses are eligible: Allowable Expenses Overview (hrsa.gov) . When considering expenses, ask yourself “Is this expense necessary and reasonable to support patient care efforts to prepare for, prevent, or respond to coronavirus?”

Q: How do I calculate lost revenues?

A: You will compare quarterly revenue in 2020 compared to 2019. Click here for more information: Provider Relief Fund – Lost Revenues Guide (hrsa.gov)

Q: If I use lost revenue for all my HHS PRF funding, do I still need to list expenses?

A: According to the HHS video, if you enter $0 on the unreimbursed expense screen, you can then apply PRF funds to the amount of lost revenue only. If the lost revenue exceeds the PRF fund of the current period, the excess may be applied toward future PRF payments.

Q: How does the reporting work?

A: Click here for a tutorial on using the reporting: Provider Relief Fund Reporting Tutorial – YouTube

Q: How do I report the money I received?

A: Click here to register and complete the report Home (hrsa.gov)

Example:

Practice received $5,000 in June 2020, $20,000 in September 2020, and $50,000 in January 2021.

Practice collections in Q2 2020 were $100,000 less than in Q2 2019

Period 1: 4/10/20 – 6/30/20 ($5,000)

Amount received is under $10,000, no reporting requirement

Period 2: 7/1/20 – 12/31/20 ($20,000)

Reporting must be completed between 1/1/22 and 3/31/22

$100,000 of lost revenue reported, $80,000 excess carried forward to next reporting period

Period 3: 1/1/21 – 6/30/21 ($50,000)

Reporting must be completed between 7/1/22 and 9/30/22

$80,000 excess lost revenue from prior period used towards $50,000 PRF (HHS) money received.

$30,000 excess lost revenue carried forward to Phase 4, if applicable

**If there is not sufficient lost revenue equal to the amount of HHS money received, expenses will need to be reported to avoid repayment

Q: Will a practice need to return these funds?

A: Practices will not need to return the funds, IF they are used for eligible uses not reimbursed from other sources and/or cover lost patient revenue.

HHS Provider Relief Fund – Phase 4 Funding

Q: How are payments calculated?

A: Click here: Payment Methodology | Official web site of the U.S. Health Resources & Services Administration (hrsa.gov)

Q: Should I apply and do I qualify?

A: Each practice should evaluate their revenue losses during the period below and increased expenses due to Covid.

HHS will deduct prior Provider Relief Fund (HHS) payments that were not previously deducted in Phase 3. This will allow providers that have never benefitted from the Provider Relief Fund to receive greater financial support.

Q: What periods are being compared for lost revenues and increased expenses?

A: Using your dental software collections (not QuickBooks) compare:

Q1 (Jan -Mar) 2021 compared to Q1 2019

Q3 (July-Sep) 2020 compared to Q3 2019

Q4 (Oct-Dec) 2020 compared to Q4 2019

Q: When is the due date to apply?

A: October 26, 2021

Q: Is there reporting required?

A: Yes, similar reporting as prior phases will be required (see above)

Q: How does a practice apply for Phase 4?

A: Start by looking at the flowchart, click here: phase4-arp-application-visual.pdf (hrsa.gov)

Q: What link do I use to register and apply?

A: Click here: Home | COVID-19 Cares Provider Relief Fund (linkhealth.com)

HHS will deduct prior Provider Relief Fund (HHS) payments that were not previously deducted in Phase 3. This will allow providers that have never benefitted from the Provider Relief Fund to receive greater financial support.