In 20 years, I have yet to meet a merchant who does not want to pay the “lowest” processing percentage. Rest assured: When shopping for a credit card processor, there is no shortage of

reps who will promise you that their rates are

indeed the “lowest.”

When going down this path, though, please

note two things:

* The processor may be willing to sign you up for that low rate, but they do not want to maintain that percentage for very long. This will undoubtedly result in a rate increase within a few months, usually without notification.

Now you are paying more than you bargained

for and are stuck doing so because you signed a 3-year contract.

* High month-end fees, which often are not discussed during the sales process, can more than offset that “low processing rate.” There are statement fees, transaction fees, WATS fees, dues & assessments plus any others the credit card

processor can think up and sneak by you.

It’s not so much that these fees exist; it’s that they are often used as a way to counter the low rates.

What this all means is that when “shopping” for a credit card processor, look for the following:

* Fair & Reasonable Processing Rates

* Minimal Monthly Fees

* No 3-Year Contract to Sign

* Superior Pre- & Post-Sale Customer Service

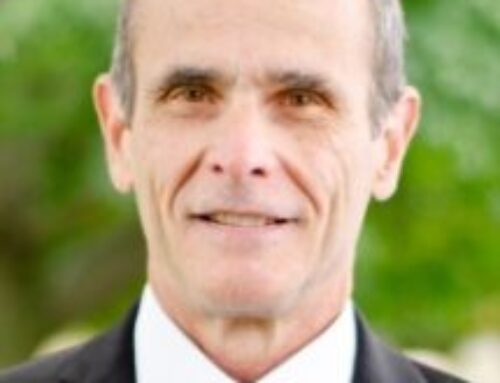

Bob Kagan

Summit Network LLC

www.summitnetworkllc.com

bobkagan13@gmail.com 781-820-4328

Credit Card Processing Made Easy