From Brabo Insurance’s Plymouth Chamber Presentation:

HireNow Requirements:

The employee must work 30 hours per week –An average wage report would be a good document to provide if needed for audit.

> Must be employed for 60 days

> Makes between $14.25 ($6.15 tipped) and $42.50/hour (no more than $85,000 annually for exempt employees)

> Massachusetts based Company (for profit and not for profit) & Massachusetts Based Employee

> Company is registered with Program

> Hired between 3/23/2022 and 12/31/2022

> A part-time employee that changes status to full-time is not eligible

> Employees who are rehired after 03/23/2022 are eligible as new hires for the program

> A single individual may be enrolled as an eligible new hire only one time during the life of the program, per employer. Even if the employee leaves the company and is re-hired later, an employer may only apply for HireNow funds once for this individual.

Eligible Primary ContactThe person responsible for administering the grant

> Each company must designate one “PRIMARY CONTACT”

>Essential to prevent fraud

> Must be a payroll employee of the company (W2)

> Can not be your accountant / payroll company etc.

> Can be non W2 owner but must verifiable by State of MA independently

> Audits may be required and the Primary Contact is accountable to the audit

Payment & Audit

> Will be done via Electronic Funds Transfer (EFT) **REQUIRED**

> These are not tax credits, these are grants

> Failure to comply with audits will result in a claw-back

> False Claims are considered Fraud

> Participation in other Grants does not exclude you from this Grant

> First come, first serve basis

Where do I Create My Account?

https://commcorp.org/hirenow/apply/

> You will need your EIN number

> Address

You will need to provide examples of how you will use funds, at this time.

Use of Funds

Used to subsidize additional time spent shadowing more experienced colleagues or on extended on-the-job training during an onboarding period

> Used to hire an external training provider to provide technical skills training

> Used to incentivize hiring, allowing an employer to offer a sign-on bonus to job candidates if they accept an offer and remained employed for 60 days

> Used for a new hire a retention bonus following a certain number of days at the organization

> Used to offer tuition reimbursement benefits.

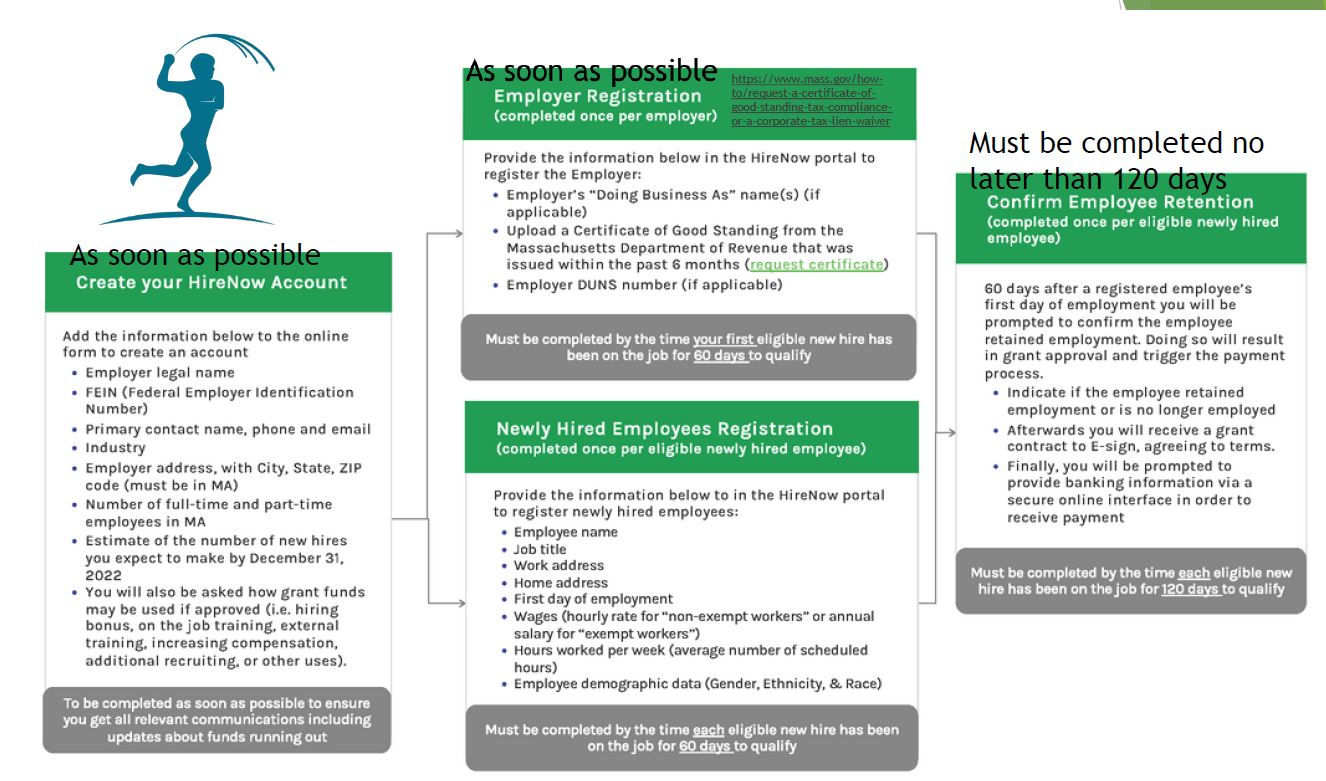

DEADLINES

Two Critical Deadlines

Must register newly hired employees within 60 days of hire

> Must complete the Company Registration Process and verify that an employee has retained employment for 60 days or more no later than 120 days after their first day of employment. After this is done, it will trigger the payment process.

> Grants are awarded on a first-come, first-serve basis

> Money will run out!

Not Eligibles

Contractors

> Employees of Government entities

> Someone you train and they leave before 60 days

> Temp Agency Employees who get a W2 from the Temp Agency

> Owners

> Anyone who averaged less than 30 hours

Source and Administration

What is the source of the funds used for this program?

>> This program is funded by the American Rescue Plan Act of 2021.> Who is administering the HireNow grant program?

>> HireNowis a program of the Commonwealth of Massachusetts’ Executive Office of Labor and Workforce Development. The program is administered by the Commonwealth Corporation, a quasi-public state agency based in Boston.Home Based Businesses/Work from Home

Eligible employers must have a Massachusetts business location.

> Please note: Employees’ homes are not considered Massachusetts work locations in any scenario (e.g., even under remote work). The employer must have a physical business location in Massachusetts. The employer is not required to be headquartered in Massachusetts.

> Home based businesses are eligible if they meet all the other requirements.

OTHER QUESTIONS

> Are grant funds taxable income? (commcorp.org)

> The receipt of a government grant by a business generally is not excluded from the business’s gross income under Internal Revenue Code and therefore is taxable. However, grant recipients should consult with their tax advisors to determine tax liability for their organization.

Help & Support

Please use the “Help & Support” form below to submit questions or request support. Monday through Friday from 9 am –5 pm you may call (617) 789-8573 for live support.

Jenn Deegan

Client Advocate and Opportunity Generator

Brabo Insurance

65 Cordage Park Circle Suite 120

Plymouth, MA 02360

508-927-6499 direct line

508-830-3800 x101